As Europe’s life sciences sector undergoes major transformation, Switzerland remains a global innovation leader—but rising talent shortages and demographic shifts are putting pressure on its future. This article explores how companies in Switzerland can stay ahead of workforce challenges by rethinking how they attract, retain, and develop specialised talent in a highly competitive field.

Europe’s life sciences sector is in flux. As the region navigates geopolitical uncertainty, aging populations, inflation, and digital transformation, life sciences organisations are under pressure to reimagine how they attract, develop, and retain talent. New research from Gi Group Holding and Lightcast (“Life Sciences European Worforce Outlook”) paints a clear picture: while life sciences remains a powerful engine of innovation and employment, talent gaps and demographic shifts could compromise future competitiveness if left unaddressed.

Key European findings: Innovation is thriving, but so are challenges

Europe’s life sciences industry contributes over €585 billion annually to the economy. Sub-sectors like biopharma and MedTech are expanding, and research labs continue to fuel new breakthroughs. Yet growth is uneven. Western hubs like Germany, France, and Switzerland are experiencing restructuring, while Eastern markets—Bulgaria, Hungary, Latvia—are booming due to cost advantages and emerging talent pools.

Despite high job demand, skills mismatches are widening. The sector faces a “quiet crisis”: an abundance of vacancies but not enough qualified candidates to fill them. In fact, between 2022 and 2024, life sciences job postings across Europe exceeded 250,000—but demand for key roles like neurodiagnostic technicians and medical device specialists far outpaced supply.

Inflation further complicates the picture. Rising living costs increase wage expectations, while economic uncertainty reduces workers’ willingness to switch jobs. As a result, high-performing talent is becoming harder to attract and even harder to retain.

Shift in balance between technical qualifications and human-centric skills

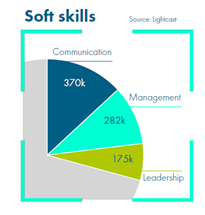

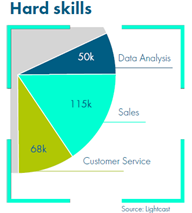

While hard skills such as data analysis, regulatory knowledge, and laboratory techniques remain essential, the demand for soft skills is increasing rapidly. Employers across the life sciences industry are placing growing value on adaptability, collaboration, and problem-solving—traits seen as crucial in interdisciplinary research settings and fast-evolving regulatory environments. The ability to lead cross-functional teams, communicate across departments, and navigate ambiguity is becoming just as important as technical expertise in many roles.

Stéphane Miras, Director Life Sciences at Gi Group Switzerland, underscores the complexity of this challenge in the report:

«As Western populations age, demand for specialised skills in areas like orthopaedics and diabetes management is surging. Simultaneously, employers must adapt to the disruption brought by AI and automation. Talent shortage is a growing reality, with half of workers likely needing to reskill in the coming years. Our clients are increasingly challenged to keep pace with these changes and secure the right talent. Access to these skills is vital for maintaining competitiveness and driving growth. External recruitment expertise – professionals with deep knowledge of the life sciences sector – offers significant value.»

|

Demand is rising for communication, management, and leadership skills—vital for driving change and innovation. Project management and operations are also key to smoothly integrating new technologies. |

|

As life sciences shifts toward digital health, demand is growing for data analysis, sales, and customer service skills—key to tech adoption and delivering patient-centred outcomes. |

Switzerland: high performance, but under pressure

Switzerland holds a unique position in the European life sciences landscape. The country is a heavyweight in biopharma, contributing the highest GDP output in the sector across Europe. Its MedTech workforce is the second-largest in the region, and it remains a top hub for research and testing.

However, warning signs are flashing. Switzerland’s life sciences employment has plateaued, and restructuring—especially in middle management—has led to job reductions. At the same time, demographic challenges are intensifying. Youth participation in the sector has declined, and the country is experiencing a marked increase in older professionals. The risk: insufficient talent to fill future roles in R&D, manufacturing, and digital health.

Tackling the talent crunch: three Swiss priorities

- Revitalize the pipeline with young talent

Switzerland’s shrinking youth employment rate in life sciences (just 5.8% in 2023) is a red flag. Companies must reinvest in partnerships with universities, apprenticeships, and early-career STEM (Science, Technology, Engineering, and Mathematics) programmes to rebuild the entry-level talent pipeline. Targeted initiatives to draw younger professionals into biopharma and MedTech will be critical to long-term sustainability. - Retain expertise with flexible models for senior talent

The “greying” of Switzerland’s workforce isn’t inherently negative. In fact, older workers bring critical institutional knowledge and mentorship potential. With smart strategies like phased retirement, advisory roles, and targeted reskilling, employers can harness this “longevity dividend” and maintain continuity across complex operations. - Upskill for digital and operational transformation

Life sciences is evolving toward AI-powered drug development, real-time diagnostics, and hyper-efficient production. Switzerland’s success hinges on its ability to retrain its current workforce in data analysis, quality control, automation, and compliance. Roles like lab technicians and research managers remain core, but emerging skills in digital therapeutics and tech integration are increasingly critical.

Added value from Switzerland’s strengths

Switzerland’s high productivity, global R&D reputation, and quality-first culture remain vital advantages. But to stay competitive, Swiss firms must embrace a dual strategy: deepen specialisation in core areas like biopharma, while also building agility through targeted recruitment and workforce innovation.

One opportunity lies in leveraging Switzerland’s multilingual and internationally mobile workforce. With strong talent attraction capabilities and access to global life sciences markets, Swiss companies can look beyond national borders to fill specialised roles—especially in regulatory affairs, clinical trials, and quality systems.

What leading companies are doing differently

Forward-thinking life sciences firms are already implementing hybrid workforce models, combining internal capability development with external recruitment solutions like RPO (Recruitment Process Outsourcing) and MSP (Managed Service Providers). These models enable agility in fast-changing regulatory environments and support high-volume hiring during clinical trial rollouts or product expansions.

As Stéphane Miras points out: “We see this shift daily. Companies no longer just want “candidates”—they want workforce partners who understand the regulatory, scientific, and cultural nuances of life sciences hiring. Whether it’s sourcing a data-savvy quality control analyst for a Basel-based biotech firm or assembling a multilingual MedTech team in French-speaking Switzerland, local knowledge and sector expertise are essential.”

Reimagine talent to remain competitive

Switzerland’s life sciences sector holds world-class capabilities—but it’s at an inflection point. Maintaining its leadership position will require bold workforce transformation: training new talent, empowering experienced professionals, and partnering with experts who understand the unique demands of life sciences.

Stéphane Miras explains how Gi Group Switzerland can help: “At Gi Group Switzerland, our Gi Life Science division is exclusively dedicated to supporting companies in the life sciences sector. Our specialised team connects life sciences organisations with the talent they need to thrive—covering all functions across the industry. From scientific and technical roles to administrative and support functions, we recruit experts across the spectrum: MedTech engineers, clinical trial managers, compliance analysts, data scientists, and more. Whether you’re scaling R&D, expanding manufacturing, or navigating regulatory complexity, we’re here to help.”

About Gi Group Switzerland

Gi Group Switzerland is part of Gi Group Holding, a global leader in HR services operating in over 30 countries. With 40 offices across Switzerland, Gi Group provides customized staffing solutions, including temporary work, permanent placements, executive search, and outsourcing. Our extensive local presence and international expertise enable us to match businesses with the right talent—flexibly, efficiently, and strategically.